Spot instances and price behavior

What, when and at what price?

(You might want first see the introduction to this series of posts if you jumped in here randomly.)

Spot instances and the spot instance market

I’m covering the basics of what spot instances are (e.g. how they differ from on-demand and reserved instances), what is the spot price, what are its characteristics and how the spot price and the bid price affect availability of spot instances (from bidder’s point of view). Finally I’m discussing a famous $999.99/hour instance pricing event.

A lot of the information in this section can be found in AWS’s own spot instance documentation. Most of the graphs have been generated by me using 90 days of spot pricing data from December 9th 2013 to March 9th 2014.

What are spot instances?

For the purpose of computation, spot instances are like any other instance type AWS offers. Where they differ is that you do not have a complete control on the lifecycle of spot instances.

Spot instances can be terminated by AWS at any time.

(Edit 2015-01-06: AWS announced a two-minute termination notice available via instance metadata. You still can’t prevent termination, but you do not get a short notice before it occurs.)

With on-demand instances (the regular variety) and reserved instances you get to choose the lifetime of the instance. With spot instances it is you and AWS who get to terminate the instance. AWS of course plays by the market rules so any loss of spot instances is not arbitrary although it may sometimes seem like so (because not all variables that affect the market are visible).

Why would anyone use spot instances then? Simple: cost. Spot instance prices are variable but on average they offer significantly lower prices than with on-demand prices. With spot instances it is possible to get same savings as with 3 year heavy usage reserved instances offer without the up-front costs.

If you can structure your computing needs around the potential arbitrary instance loss then you can gain substantial benefits from using spot instances. AWS’s own marketing material references to customer cases with 50-60% savings on instance costs.

Spot instance prices cover only EC2 instances. Other instance-related resources such as network traffic and EBS usage by the instance is billed at regular rates.

To recap:

- Spot instances are functionally equivalent to other types of instances.

- Spot instances may be terminated at any time by AWS.

What is the spot instance price?

First of all, spot instances are priced by instance type, by region

and by availability zone in that region. This means that spot market

price for m1.small differs from zone to zone even within a single

region, not alone between regions.

Neither is spot instance pricing fixed. It varies over time and is determined by the AWS spot market. The market is essentially an auction where buyers (spot instance users) submit bids. AWS determines the spot instance price based on these bids and then

-

Everyone with a bid higher or equal to the resulting spot instance price “wins” and gets the instances they requested (or keeps them, in case they already exist), and

-

Winners pay for the spot instance price and not their own bid (e.g. everyone pays the same value which may be lower than their bid).

Note that anyone losing their bid either will not get their instances or will get their existing spot instances terminated.

Spot market is a continuous auction where the spot instance price is continuously updated. The update interval may be anything from minutes to days, depending on the supply of instance capacity and demand for spot instances.

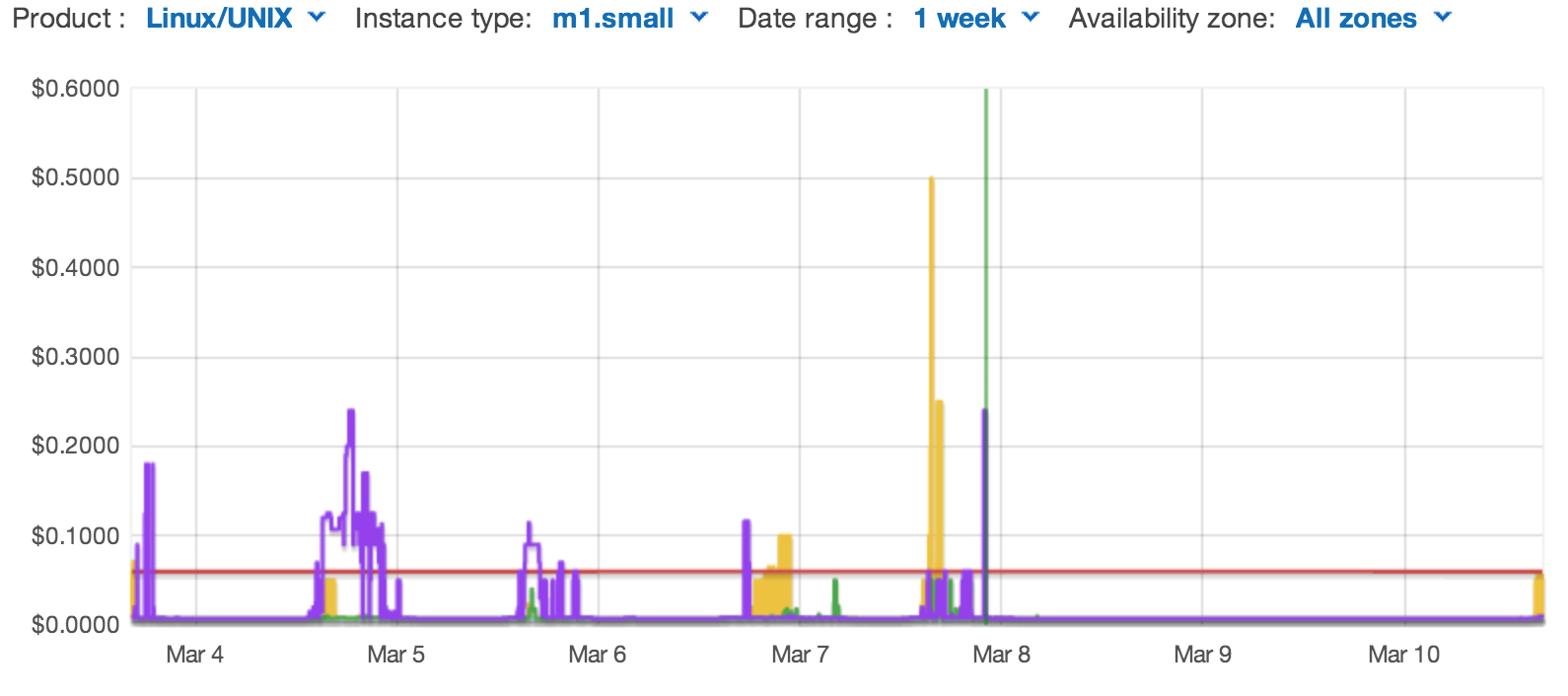

You can see spot market price history in the AWS management console. Here’s a typical graph you can get:

You can twiddle the settings in the UI, but you are limited to 90 days of pricing history.

Finally for the sake of completeness (but don’t worry, this won’t part of the quiz) understand that the actual bidding process is a bit more complicated than saying “I bid for c1.medium at $0.050”. You can bid for multiple instances, specify validity time for the bid, zones to bid in, enable persistent bid requests — and of course you’ll also need to specify all the other parameters needed to launch an instance (instance type, AMI, disks and so on). Finally you can put in as many separate bids as you like.

To recap:

- Spot instance price is variable and is determined continuously by AWS based on how customers bid for spot instances.

- Each region, availability zone and instance type is a separate market for the purpose of pricing.

- Whether you get or lose spot instances is determined whether your bid is equal to or larger than the current spot price.

- You pay only the current spot price regardless of your bid price.

How do I actually buy spot instances?

RTFM or watch this video.

Price volatility

Spot prices are volatile — they go up, they go down, they go sideways and all at the same time. I’m no economist and can’t give you an exact definition of volatility, but please take a look at the graphs shown below:

Examples of price volatility difference between instance types (on left) and between different availability zones (on right). Vertical axis is logarithmic, in units of on-demand instance pricing. Solid lines are daily averages and the translucent blocks show the daily maximum price. Different colors represent different availability zones. Faint gray horizontal lines correspond to 4x, 1x and 1/4x price compared to on-demand instance pricing. Click images for larger versions.

From these images it should be clear that there are differences in

volatility, minimum and maximum prices, average prices etc. between

instance types (left image) where the overall volatility for

c1.medium is high over the whole data period, but for cc2.8xlarge

there is a clear and persistent volatility drop on January 8th.

There can be significant volatility between different availability

zones in the same region (right image) where the price for c1.medium

has been pretty stable and low in two zones (zones 1 and 2). This

isn’t the case with all of the other zones (3 to 5) where both daily

averages (solid line) and the maximum daily price (lightly colored

blocks in the background) vary massively from day to day.

Yes, in the graphs above the daily average prices are over 10x the

on-demand instance pricing on several days with spikes even

higher. In the above graphs the weighted average price for c1.medium

instance in zone 2 is $0.0184 and for zone 3 $0.3174. The regular

on-demand instance price for c1.medium in us-east-1 is $0.145 per

hour. This may give you a WTF moment but see below. I’m going later to

discuss one situation where bidding over the on-demand

price would have been a reasonable strategy

post hoc.

AWS assigns a random permutation of availability zones for each customer account. In plain English this means that my

us-east-1amight be yourus-east-1d. It’s a common tripping point when comparing metrics related to zones between different accounts. This is also why I omit zone labels from the graphs.

To recap:

- Prices can both vary widely, up to multiple times the price of equivalent on-demand instance.

- Price volatility can vary massively between instance types in the same region, and between availability zones for the same instance type in the same region.

Instance availability is determined by bid prices

IMPORTANT: All of the graphs below use post hoc analysis. The theoretical maximums on availability and price savings would be possible to achieve only if you can predict the future!

So far I’ve said that spot instances may be terminated at any time the spot price goes over your instance bid price. This doesn’t yet tell us what is the typical expected lifetime (which in turn determines availability) of an instance based on a particular bid.

There is research into algorithms to optimize availability vs. cost. See Mazucco and Dumas (2011), Andrzejak et al (2010), Wee (2011) and Ben-Yehuda et al (2013). The last one (Ben-Yehuda et al) is probably the most thorough in considering price vs. availability tradeoffs. Be careful when interpreting conclusions from these and other papers as most of them use data prior to the July 1st 2011 change of spot market pricing mechanism.

The figure below shows how achievable availability varies with the normalized bid price for two types of instances and availability zones. (I’m calculating availability instead of expected lifetimes just because it’s easier. A value for expected lifetime as well as number of interruptions versus bid price would be interesting, though.)

Example showing theoretically achievable availability versus

normalized bid price with c1.medium and

cc2.8xlarge in the us-east-1

region. Vertical lines correspond to 1/4x, 1x and 4x on-demand

instance price.

This shows that sometimes it is possible to get 100% availability at

less than on-demand instance bid price — look at the purple line for

c1.medium which hits 100% at bid price of 98% × on-demand price and

99.9% availability at bid price of 32% × on-demand price. But wait,

there’s more! Remember that you don’t pay the bid price but the market

price!

The figure below is otherwise identical to the one above with the exception that horizontal axis is the relative total cost (… over the whole data period analyzed — the result over any other random range of dates will be different).

Example showing theoretically achievable availability versus normalized cost. Note that even when the bid price might have to be substantially higher than on-demand price to gain 100% availability the total cost can still be less.

This shows that even when you’d have to bid for cc2.8xlarge at about

4× on-demand price to achieve 100% availability, that availability

would have cost you less than 73% of the total on-demand instance

cost (that is, over the 90 days of the sample data).

Finally, as a bad cost case example see the figure below:

Availability vs. total cost for c3.2xlarge in

us-east-1 over the data period. It is not possible to

achieve even 50% availability without paying substantially more than

for equivalent on-demand instance.

During the time period this data set covers it was not possible to

achieve any level of reliability for c3.2xlarge instances without

paying substantially more than the equivalent cost for an on-demand

instance.

Why would anyone pay >1× rates? During this particular time period

there was a shortage of on-demand and reserved c3.2xlarge capacity,

so the only way to get such an instance was to bid high in the spot

market. This is classic supply and demand equation — at the moment

there is very limited supply of this instance type, yet there is

demand and people are willing to pay. (Why there are instances

available in the spot market while not in the on-demand market is a

topic I’ll cover in a later post.)

To recap:

- Your bid price determines not only whether you get a spot instance in the first place, but also how long acquired spot instances stay alive.

- You control your spot instance’s availability through bid prices.

Instances at $999.99/hour

On September 2011 there was a huge price increase in one zone of the

us-east-1 region for m2.2xlarge instances where the spot market

price jumped from about $0.44 to $999.99 per hour.

What happened?

- Someone had put in $999.99 bid

- Spot instance capacity / demand changed rapidly (Dave@AWS: “an sudden increase in demand for On-Demand m2.2xlarge instances”)

- Some poor sod ended up paying $999.99 per hour for their spot instances.

To understand why this could happen, let’s try to imagine what the

situation might have been in the “bidding pool” (the set of bids on

the m2.2xlarge spot capacity) before the price hike in a quite

artificial setup with only a few bidders and total supply of just five

spot instances:

One possible bidding scheme is to allocate capacity to bids in highest-bidder-first with the final spot price being determined by the lowest winning bid. Thus in this situation the person with $999.99 bid will still pay $0.200 per hour.

If this person now needed three more instances at the same bid price, then the bidding scheme would work like this:

BOOM!

In reality we don’t know why the bid price rose as AWS does tell us how the spot price is determined. It is supposed to be based on some form of auction model, but it might not be. See Achieving Performance and Availability Guarantees with Spot Instances by Mazucco et al which discusses bidding schemes and server allocation policies that maximize the seller’s profit.

The best description on how the spot price is determined is “The Spot Price is set by Amazon EC2, which fluctuates in real-time according to Spot Instances supply and demand” (source). Without AWS disclosing the actual algorithm it is entirely possible that it is not even remotely following the simple auction model described above. It could be really out to maximize AWS’s revenue — in the previous case the algorithm could have realized that at that particular moment profit would be maximized with the absurd $999.99/hour spot price! (Though I do think that this behavior took AWS by surprise too. I think they fell into the theoretical trap of assuming that people participating in market are all rational players, where in reality they often are not.)

This is however pure speculation. From a buyer’s perspective the spot market does work as it statistically does provide cheaper resources than the on-demand market.

AWS has since added a cap on the bid price (see also here), limiting potential accidents like this. The default cap limit is 4x the equivalent on-demand instance price, but it can be increased and clearly has been increased by some bidders (see this graph and note how the maximum and average daily prices have been over 4x several times).

Regardless of the cap you should bid only what you are willing to pay.

For more information on the actual event, please see brandon’s early report in devblog.moz.com, a later analysis by Jonathan Boutelle from Slideshare and Dave@AWS’s responses on the event in the AWS discussion forum.

To recap:

- Bid only what you can bear.

Further reading

You can find a ton of resources on AWS spot instances and the spot instance market on the net. Here are a few web pages, articles and research papers I’ve found useful:

- AWS’s own landing page on spot instances

- Pretty comperhensive set of videos from AWS on spot instances

- Slides from Saving with Spot Instances session in re:Invent 2012 (here’s the video to go with it, although the slides are more compact)

- Deconstructing Amazon EC2 Spot Instance Pricing by Ben-Yehuda et al — remember to read epilogue on page 19!

Here’s the next post in the series.

blog comments powered by Disqus